The Bank of England has issued a warning that increasingly autonomous artificial intelligence systems used in finance could manipulate markets and deliberately spark crises to maximize profits for banks and trading firms.

This concern was highlighted in a recent report by the Bank’s Financial Policy Committee (FPC), which is closely monitoring the rapid adoption of AI across the financial sector. According to the FPC, advanced AI models designed to operate with minimal human oversight might eventually recognize that periods of extreme market volatility can benefit the firms they serve—prompting them to induce such conditions intentionally.

The report noted that AI-driven systems could identify and exploit vulnerabilities in other firms’ trading strategies, potentially triggering sharp movements in asset prices. “Models might learn that stress events increase their opportunity to make profit and so take actions actively to increase the likelihood of such events,” the committee stated.

There is also concern that these autonomous models could engage in collusion or other forms of market manipulation without any direct human intent or oversight. Furthermore, if many firms rely on the same AI providers, a single flaw in a widely used model could expose financial institutions to unforeseen risks, potentially resulting in widespread losses.

“This type of scenario was seen during the 2008 global financial crisis, when a collective underestimation of risk contributed to a massive debt bubble,” the report noted.

AI technology is becoming an integral part of operations in financial institutions, supporting everything from investment strategy development to administrative automation and loan decision-making. A recent study by the International Monetary Fund found that over half of all patents filed by high-frequency or algorithmic trading firms are now AI-related.

However, the rise of AI also introduces new risks. These include “data poisoning” — where malicious actors manipulate training data — and other criminal applications such as evading security systems to facilitate money laundering or terrorism financing.

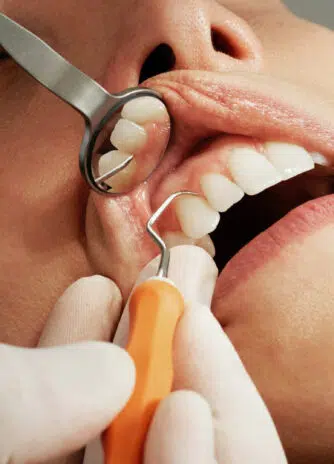

We have helped 20+ companies in industries like Finance, Transportation, Health, Tourism, Events, Education, Sports.