The US Consumer Financial Protection Bureau (CFPB) is stepping up oversight of major digital payment providers, bringing them under regulations similar to those governing banks. On Thursday, the CFPB announced a new rule targeting digital wallets that process over 50 million transactions annually, including Apple Pay, Google Wallet, PayPal, Cash App, and others.

The rule aims to align digital payment platforms with the same legal standards that apply to credit unions and large banks. It grants the CFPB authority to conduct “proactive examinations” to ensure compliance with federal privacy, fraud prevention, and other regulatory requirements.

This measure builds on a previous CFPB proposal that sought to regulate payment providers handling over 5 million transactions annually. The finalized rule narrows the scope but still covers the largest platforms, which together process more than 13 billion transactions annually.

“Digital payments have gone from novelty to necessity, and our oversight must reflect this reality,” said CFPB Director Rohit Chopra. He emphasized that the rule is designed to safeguard consumer privacy, protect against fraud, and prevent wrongful account closures.

The regulation will officially take effect 30 days after its publication in the Federal Register.

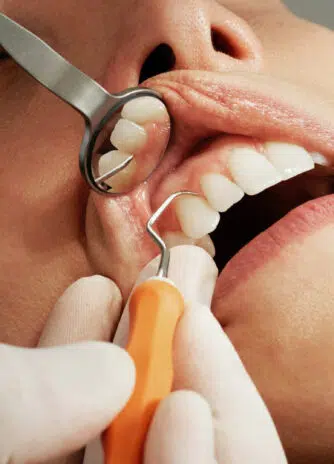

We have helped 20+ companies in industries like Finance, Transportation, Health, Tourism, Events, Education, Sports.