Global financial regulators are stepping up efforts to monitor the growing risks linked to the rapid adoption of artificial intelligence across the banking and financial sectors.

Authorities are increasingly concerned that institutions rely too heavily on the same AI models and specialized hardware, creating potential “herd effects” that could amplify systemic risks.

“This heavy reliance can create vulnerabilities if there are few alternatives available,” warned the Financial Stability Board (FSB), the G20’s risk oversight body, in a new report.

A separate study from the Bank for International Settlements (BIS) echoed those concerns, calling for an “urgent upgrade” in how central banks and regulators approach AI. The BIS said supervisors must strengthen both their ability to understand AI’s impact on the financial system and their capacity to use the technology responsibly within their own operations.

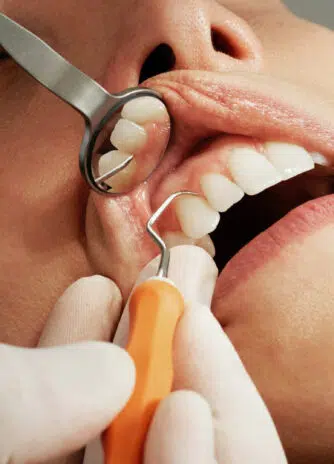

We have helped 20+ companies in industries like Finance, Transportation, Health, Tourism, Events, Education, Sports.